Kicking and Screaming

A part two extension of my previous post titled, "Clear Eyes, Full Heart, Can't Lose: Shorting the Long Bond Edition".

The Fed and Treasury are looking every which way for a reason to cut rates but still coming up empty. Under this light, it makes sense why the equity markets are strong - they have the two biggest fiscal and monetary forces in the world advocating in their corner. Despite these best efforts, we are getting closer to the point where Mr. Market will have to drag these junkies away from the liquidity trough, kicking and screaming. Mr. Market’s mechanism for this will be a continued increase in bond yields.

Give this a quick read if you haven’t already, then dive in below.

Hot, Hot, Hot

Data print after print, it is becoming clear the economy is hot. This past week both CPI and PPI came in above expectations. January’s job report was another scorcher as the economy added 353,000 jobs and the unemployment rate remained at 3.7%. Atlanta Fed’s GDPNow is tracking for 2.9% real in Q1 (~6% nominal) while wage growth is still north of 5%.

Here are a few additional callouts that highlight the theme.

(h/t

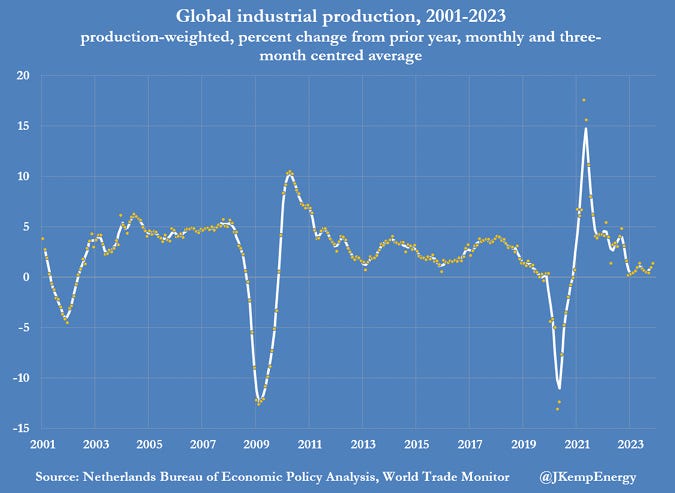

for sending)There are very few signs of weakness across the US economy and corporate earnings continue to grow. This is why the biggest risk for risk assets is not a credit event but likely in the same vein as 2022 - a late to the party Fed that has to course correct.

Consistent growth above the previous couple decades’ trend reduces demand to buy US government debt all else equal. With many market participants still nervous about a recession, this negative demand shock will likely become more apparent when they eventually throw in the towel. Whether this growth is sustainable given its largely fiscal deficit funded is a different story, but I don’t think one that necessarily matters here.

Supply

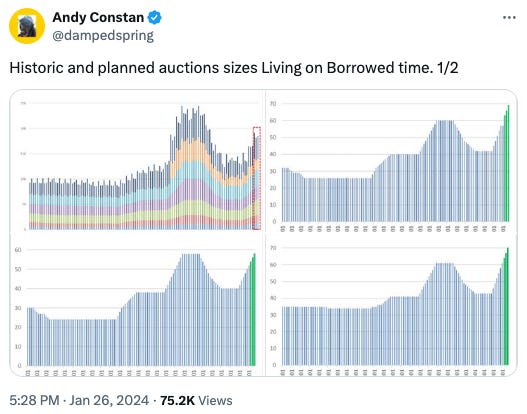

Andy Constan is the resident US Treasury debt expert on Twitter and a deep dive of his work will save a mediocre summary from me, but the moral of the story is there is a lot of supply coming to the market.

Apollo had a nice breakdown of it as well, highlighting the 23% YoY increase.

So long as the government is choosing to run large fiscal deficits, the issuance is unavoidable.

Where this also becomes problematic is the Treasury no longer has a $2.3 trillion RRP to pull from. The facility was drained over the course of 2023, sitting at $500 billion today. This draining has already begun slowing as the net bill issuance highlighted in the most recent QRA will fall meaningfully, leaving more of the burden on coupons.

Neither of these trends make Janet Yellen’s job of financing the government spending easier. Not to mention the ongoing large secular trends pointing to reduced foreign demand for US debt.

Not core to this thesis but something I am also watching is how events unfold in Japan. They have begun slowly moving away from their ultra loose monetary policy and have discussed continuing to raise rates. This remains event risk on the horizon that could be triggered as a response to an ever weakening Yen.

The economic situation in China is also interesting as you’d eventually expect the piecemeal stimulus measures to work. Given this was noted as an important source of disinflation over the course of 2023, the reverse could be true if they turn the ship around.

So what gives?

The Trade Setup

The thesis is simple. With the supply of US treasury debt inflating more than 20% YoY, that supply needs to either be absorbed by an equivalent increase in demand or decrease in price. And given I’d argue the net demand effects will also be negative, a 20% fall in the value of long duration US treasury bonds is quite conceivable.

Luckily, the consensus is not on my side as recent investor surveys from Goldman and BAML show almost no one is positioned for an increase in inflation and bond yields.

Over the course of 2024, I expect the 2s10s yield curve to continue its steepening to a positive ~100 bps.

In a range of outcomes where the 2yr is 4-5%, this equates to a 5-6% 10yr. To illustrate what this means for the front end of the curve, let’s assume the 2s-FFR is somewhere between -25 and -50 bps, owing to the fact that the market is relentless in its pursuit of rate cuts.

The 2yr is currently trading at 4.6% with a 68 bps discount to the FFR. To be conservative with this exercise, let’s say the 2yr trades at 4% with a 25-50 bps discount to the FFR, implying a 4.25-4.5% FFR. At current levels the market implies an ~80% chance the FFR will be 4.25% or greater after the December Fed meeting.

I like the margin of safety here. I think all three components I mentioned above work in my favor, but for the trade to pan out I don’t have to be right on all three. I believe expect:

2s10s curve steepens above the current -36 bps (~136 bps of target steepening to 100 bps normal curve)

2s-FFR curve normalizes in the -25 to -50 bps range (~17 bps of target steepening)

FFR ends the year no less than 4.5-4.75%

These assumptions take you to a 6% rate on the 10yr, nearly 175 bps higher than current levels. This is what I mean by margin of safety. Meanwhile, implied volatility is also very low.

Bonus Content :)

5yr yield in candles, 5yr inflation expectations in orange. A continuation of rising inflation expectations would help this case.

XLE/QQQ…the equity version of this trade.

Good post! The economy has been running hotter for a while now than most economists were expecting.

2 small pushbacks:

- Retail sales dropped by quite a bit in January

- Re “reduced foreign demand for US debt”: Brad Setser and Michael Pettis are adamant that the Chinese government is simply buying Treasuries through its banks.

https://www.bloomberg.com/news/articles/2023-06-30/china-has-3-trillion-of-hidden-currency-reserves-setser-says

Just noting I agree with conclusion but I wouldn't mess about with the steepener. Just be short 10s and chill.