Watch what they do, not what they say

A compilation of thoughts on the recent market events and their implications

The Fed blinked

If the Fed actually wanted to ‘Quantitatively Tighten’ monetary policy, they would have let SVB depositors go down with the ship. FDIC insurance covers depositors up to $250k so SVB’s lower and middle class clientele, of which there were few, would have seen their money back. Meanwhile its 94% of uninsured depositors, the highest percentage of any US bank, would have become SVB creditors and likely received 50-80 cents on the dollar when it’s all said and done.

Yet again the Fed made a decision to aid the wealthy and benefit the top income earners in the country. It’s a commonly stated narrative that inflation hurts the lower class more than the wealthy because the latter ‘can afford it’. In reality it’s quite different. CPI inflation is actually what will reverse the decades of QE that’s led to asset price inflation and it’s obvious correlation to wealth inequality. Why? CPI inflation and 0% cost of capital are incompatible. It’s useful to think about this and related topics through the lens of long vs. short duration.

Long vs. short duration

0% interest rates lead to misallocation of capital via overallocation to long duration assets. You will hear many call this ‘excessive risk taking’ but what SVB has shown us is that this isn’t necessarily the case. In a similar vein, I wouldn’t necessarily call a real estate price bubble ‘excessive risk taking’ either, but rather investors being forced to reach for a yield or return on their investment. The bubbles in long duration assets have appeared in venture capital, real estate and most relevant now, US treasuries - the safest asset in the world! You can think of duration and risk like squares and rectangles - not all risks are duration but duration is definitely a risk.

0% interest rates, which encourage excessive duration taking, can only exist when there is little to no CPI inflation, otherwise a country’s currency will face the consequences via severe depreciation (see Japanese Yen). So what does decades of QE and 0% interest rates with no CPI inflation do? It increases the value of all long duration investors’ (wealthy people) assets and 2) provides those asset owners with free or cheap leverage to be able to compound the asset price inflation further. And with no CPI inflation in sight, wages stagnate or grow slowly, and the lower/middle class (short duration investors), lose meaningful ground on a relative basis. And taking this one step further - it’s all the same trade. US economic outperformance relative to emerging markets? Technology and growth outperformance versus commodities and value? It’s all the same trade as what’s also driving in-country wealth inequality. QE and 0% interest rates create outperformance of long duration. It deemphasizes current cash flows and favors growth stories. It all boils down to the very definition of duration. But I digress.

SVB

So to recap the situation at hand. The Fed yet again saved the upper class. Maybe they took a look under the hood and the contagion potential really was catastrophic. Maybe they ran a complex cost/benefit analysis to determine the GDP impact of losing a key source of funding for the technology sector. Morality judgements aside, by backstopping 100% of SVB’s deposits, 94% of which sat in accounts with balances larger than $250k, the Fed bailed out the wealthy. Again, not trying to get into a right or wrong argument - just the evaluation of facts.

Janet Yellen’s Testimony

On March 12th the Fed announced its Bank Term Funding Program (BTFP). At first glance it was a potential solution to stem contagion by providing liquidity to all banks (more on that below). Later in the week on March 16th, Janet Yellen had a congressional testimony appearance with this to say - start at 1:30:30.

My tweet thread sums it up but essentially they are 1) arbitrarily deciding on ‘approved’ banks and 2) implicitly condoning a bank run on any FDIC institution smaller than SVB (16th largest in US). The negative consequences of this decision will be felt for years to come. Unless they course correct and decide to insure all depositors, the US banking sector will transform into an oligopoly with only ‘too big to fail’ GSIBs remaining.

The BTFP’s fine print

On Thursday last week, JP Morgan estimated the BTFP will increase the Fed’s balance sheet by $2 trillion. I’ve outlined some of the program’s key terms below, but my guess is the actual usage and balance sheet expansion is much greater. Why? At a minimum the program is the cheapest source of 2 year term funding any US bank can get, and at a maximum every bank is facing similar MTM issues as SVB and needs the liquidity. Yes I am also aware that treasury rates have rallied over the past week, thus reducing the MTM balance sheet holes. Nonetheless, liquidity is still king and this program is effective for 2 years. If rates were to rise again, MTM losses would once again widen and increase the usage of this facility. For reference - the top 50 US banks have $17.8 trillion in assets, top 100 is $19.4 trillion and top 250 is $20.9 trillion. All banks smaller than SVB (where depositors are at risk) have $9.8 trillion in assets.

Yes, this is QE

Ahh the question everyone’s dying to know. Let me take you through a simplifying example.

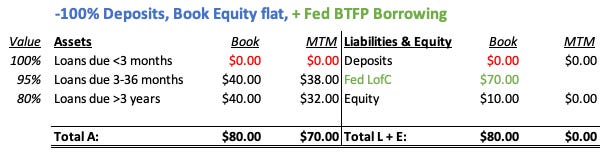

Here is an example of regional bank XYZ that is sitting on mark to market losses. They have $100 in assets if they are all held to maturity. However if they needed to sell, the loans due <3 months are worth 100%, loans due 3-36 months are worth 95% and the loans due >3 years are worth 80%. This is an example of how the true ‘mark to market’ equity value of a bank could be zero while its book value is positive. Now this is extremely simplified to make a point - these banks are running tons of analysis with a plethora of data to decide how much capital they need on hand to meet deposits. But nonetheless, bear with me.

The above example shows one of the downsides of leverage - as withdrawals increase, the bank is forced to sell more assets at a loss to meet their cash needs, losses accumulate and equity value worsens at an accelerating pace.

But now let’s rerun this with the Fed’s BTFP. Instead of having to liquidate any assets at a loss, the bank can simply borrow from the Fed against its assets and pay out those depositors with the borrowed cash instead.

Boom. Easy. Depositors get their cash, banks remain liquid. The bank also doesn’t have to recognize any losses for selling those securities so their book value remains elevated. Now back to the original question whether or not this is QE. Simple answer is yes, it is. The depositor is receiving the $40 in funds that the bank did not have on hand to pay out, thereby 1) reducing the amount of securities the bank needs to sell in the open market (less selling = good for asset prices) while 2) increasing the amount of cash in the system as the depositor takes the $40 and puts it into another bank. The best ‘this isn’t QE’ arguments stem from banks tightening their lending standards and not actually lending that new $40 money back out into the system. That may be true given recent market events, however the marginal change and new information here is the additional liquidity that this provides.

And If I am a depositor who can choose from either 1) big bank with free deposit insurance above $250k or 2) regional bank with no deposit insurance above $250k, I’m going to go with the former no questions ask. This is the biggest risk (which Yellen implicitly alluded to) that could incite a more rapid than expected deterioration in deposit bases for these regional banks. Now let’s take this one step further for illustrative sake. Let’s assume 100% of depositors pull their funds but the regional bank is able to meet the requests because of its borrowings from the Fed’s BTFP.

Similar to above, the bank is able to save face. However, the bank has no customers left so in reality its equity value would be effectively zero. In that case, the Fed has stepped in as its predominant stakeholder with the only assets the bank owns being the collateral posted at the Fed. And there you have it the Fed effectively purchasing assets similar to open market operations except with a few more steps.

When does it end?

With the BTFP, the Fed has implicitly announced its end of QT and return to QE. There are two paths:

If they continue hiking and rates move higher, the mark to market losses on banks’ balance sheets will grow. In the example above this looks like those asset values being lower, let’s say 90% and 70% instead of 95% and 80%. In that case, borrowing under the BTFP facility increases and the Fed’s balance sheet expands. As established above, this is expansionary for monetary policy.

If the Fed wants to shrink its balance sheet and reduce usage of the BTFP, they will have to alleviate the mark to market problem at the banks. This can be done either via waiting out time as the securities mature or lowering rates, thereby increasing the MTM value of the securities.

Both of the routes stated above imply looser monetary policy. Either an expanding balance sheet with direct monetary injections or lower Fed Funds rate. The other consideration of waiting out the time it takes for the maturities to mature at par requires stable financial conditions, which in itself implies a sound economy.

The other instance that would change my mind is if the government decided to insure all banking depositors no matter the amount or bank. This would alleviate the concerns of a bank run and reduce the need for the BFTP. In that case I would imagine this doesn’t get a ton of usage and may or may not be wound down. But this is not anything controversial - in that case you would simply see a reduction in the Fed’s balance sheet.

So moral of the story - watch the balance sheet.

Credit Suisse et al and the broader macro picture

At this point we are all well aware of the banking crisis. It has made its way through the headlines outside beyond just the financial community. Additionally, the Fed has responded swiftly and in size, granted not 2020 COVID size but considering the underlying health of the economy today vs. then, it is a lot. The first week of BTFP alone was ~50% of all of QT’s reduction to date.

Not only is this happening in the US but global central banks are getting in on the action as well. When Credit Suisse’s problems came further to light the SNB provided significant emergency liquidity and sped to close a merger with UBS in less than a week. I love macro doom and gloom as much as anyone but this is not 2008-2009 GFC. As mentioned above, this is predominantly a duration issue and not a credit / underlying asset quality issue.

Additionally, with the US Treasury racking up spending deficits in the range of 5-10% of annual GDP, there is an implied floor on economic activity. The US is running deficits equivalent to that of previous wartime or severe economic recession and the economy is chugging along. We’re about a year past oil’s peak prices which is beneficial for the consumer as well. So if we know the Fed has taken its foot off the gas, can’t reaccelerate QT for some time and rates have effectively peaked - that is supportive for the economy and assets.

Time to add risk?

So with all of the above said, I am still a bit skeptical on most risk assets for the time being. Historically speaking the Fed doesn’t fully pivot until ~8 months after pausing rate hikes given they’re perpetually behind the curve. I don’t think the recent moves by the Fed really change the direction of the underlying economy. It doesn’t change much for the underlying currents affecting companies’ earnings or revenue growth. The economic data is a mixed bag at best and pointing towards full blown recession at worst so time will tell how that plays out so with earnings multiples still elevated and potential growth being contained, I don’t think there’s any rush to buy equities.

So I think we are in a secularly different stop and start type of environment. As mentioned above, I think the level of fiscal spending keeps the economy in motion with intermittent bouts of inflation reappearing, so keep an eye on oil for a leading/coincident indicator there. We may even see inflation numbers start improving here to the downside which could bail the Fed out to some extent - i.e. coincident with them taking their foot off the gas. Generally speaking though I think it doesn’t completely return to its previously low levels anytime soon and that puts somewhat of a floor on yields as well. But if I’m the Fed and we’re playing a long game, that’s sort of what they want. The ability to keep rates elevated for an extended period of time, even if it’s two steps forward one step back - this is a multi year game.

What we’re seeing here is a bifurcation between the financial and real economy. One where things started to break in the financial system much sooner than the real economy which has led to the decisions the Fed has been forced to make. This is definitely bullish gold and likely Bitcoin as well but it’s important to remember QE doesn’t cause CPI inflation or significant changes to GDP growth. Equities were range bound the whole decade of the 1970’s. Japan’s equity index, the Nikkei, hasn’t reached its January 1990 peak. We’ve arrived to the point where the Fed is forced into QE just to keep things afloat. Two charts that are important here:

Gold priced in JPY terms - this is what happens to gold when its priced in a currency where the central bank isn’t doing QE (wink wink), they’re just expanding the balance sheet and buying assets. The BOJ has to print just to keep the lights on.

Gold / TLT (US treasury bonds) - this chart will follow the former. The US is in this period where they can’t send rates back to zero due to persistent inflation, but they need to support the financial system. This can also be called ‘never ending asset purchases’, also known as QE.

What about crypto?

Well if there’s ever been a time for crypto to shine, it’s now. It was literally created during the depths of a banking crisis and near financial system collapse. Now we have that plus a future banking oligopoly in the US which will make basic financial services even less accessible for the lower and middle class. This is the exact reason cryptocurrencies and digital assets were created - to address the need for a real store of value asset and the democratization of the financial system.

It feels like we’re finally on the doorstep of that turning point. The Fed blinking is their admittance of what we’ve all been expecting - even with a somewhat healthy economy, the leverage in the system is unsustainable and requires further easy monetary policy. In other words, you can’t tighten a ponzi scheme (here and here). And if Bitcoin holders didn’t sell despite all of the negativity thrown its way last year, they will only be hardened by recent events. 70% of all BTC hasn’t moved in over a year and 50% hasn’t changed hands in over 2 years.

With that said, I don’t think it’s a straight line up. Historically I have held the belief that until proven otherwise, crypto will trade like levered tech. Hopefully this is no longer the case for Bitcoin and it starts to trade more like gold, however not all crypto assets are created equal. In a world where there’s a secular shift higher in interest rates and cost of capital, similar to equities it’s not a given that more speculative digital assets will also perform well. The crypto economy is small enough whereby the ecosystem will benefit from strong Bitcoin performance, however there is still a lot of speculation that can be washed out. I definitely don’t see the need to move further out the digital asset risk curve yet given my near-term bullishness on BTC dominance.

Long gold, long Bitcoin.