We are approximately half way through what I think will be one of the most iconic (and obvious in hindsight) rallies in Bitcoin’s (and broader crypto’s for that matter) history. Despite many of the clear catalysts, the majority of investors have been caught offsides with no easy entries for the underexposed. While I noted my near-term caution last week, I don’t think time is a bear’s friend. Too much capital ready to buy a dip may prohibit us from seeing any meaningful pullback.

We may be watching a large 4 week TWAP on Bitcoin since October 23rd. This pace of buying extrapolated forward puts price in the low $40,000s in January.

The liquidations we saw last Tuesday could have been what was needed for a near-term flush. The 4H RSI divergence would agree.

Zooming out, the rise in futures open interest does not actually look that crazy given the recent run up in prices.

Over the last few weeks I have been a broken record on how both the macro and micro are lining up for Bitcoin. It can be summarized by the trifecta of:

April's inflation halving from 900 to 450 BTC/day, removing ~$6B of annual sell pressure

I believe the market is still acting as if this is another 'flash in the pan' moment for crypto, and its underlying fundamentals, when in reality I believe this is a 'third times the charm' moment. March's banking crisis and the summer's ETF rumors were breaths of life into the digital asset ecosystem, while the upcoming ETF approvals will be a fully charged oxygen tank with a resuscitator. This is a definitive signal to the world that crypto is here to stay and you need exposure.

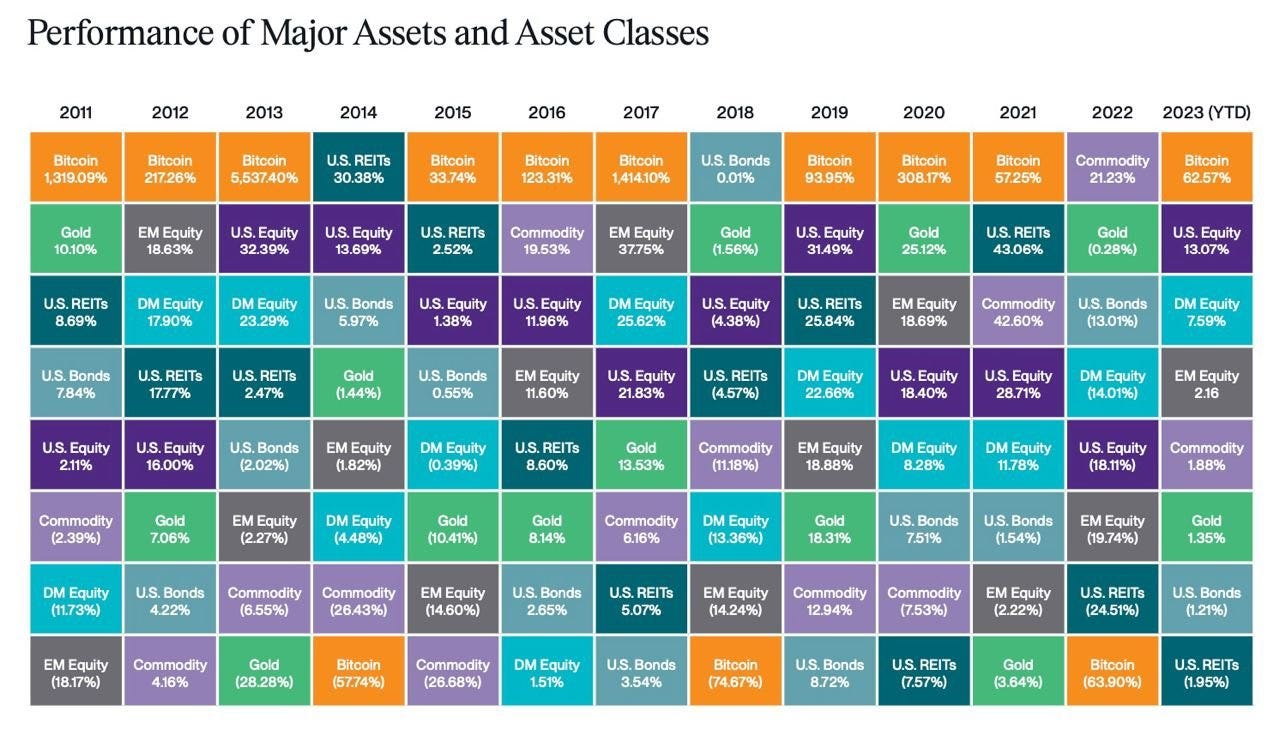

Stan Druckenmiller speaks for the world in his recent interview with PTJ when he said “I like them both. I don’t any Bitcoin to be frank, but I should. I do own gold.” The complacency across asset allocators is still too high. Bitcoin is the top performing asset in 10 of the last 13 years and cannot be ignored for much longer.

I’ll provide a short review of the macro and micro catalysts I’ve been tweeting about extensively and then dive into what I think is up next.

Macro

If you haven’t read my Q4 outlook, I suggest doing so. It provides a background understanding of many of the drivers I often refer to. To summarize my macro view:

The financial community is still heavily focused on the Fed when in reality it’s the US Treasury who is in the driver’s seat. This is called fiscal dominance. The Fed is trying to solve an eventually impossible problem by maintaining market stability and reducing inflation while the government is deficit spending at a pace that normally coincides with economic recessions. The Fed will not be able to continue quantitative tightening once the Treasury finishes draining the RRP. Watch the 2s10s yield curve for your tell and give this recent report from the Treasury a read.

The Treasury and Fed have been engaged in covert yield curve control for over a year now (since October 2022) and the depletion of the RRP will remove one of their important tools that has allowed them to keep their YCC actions ‘covert’ to date. YCC is supportive of nominal asset prices but bad for real returns of risk assets over a long time horizon. Gold, digital gold and commodities will benefit from these actions.

Evaluating dollar strength or weakness relative to other currencies misses the forest for the trees. The actions of global fiscal and monetary leaders over the past few decades has changed the game. The fact of the matter is that all fiat currencies are being depreciated at a drastic pace. Despite this secular shift having begun a number of years ago, the collective realization of this fact by the investment community will put the knock on effects into overdrive.

Everything leads to a cap on real interest rates. I have been spoken at length on this topic (see here, here and here). The situation can be summarized as follows. While the US government’s debt/GDP is well over 100% and annual fiscal deficit spending is increasing that number, rising nominal interest rates become increasingly problematic. Higher nominal interest rates can be tolerated so long as economic growth and inflation are increasing. All three of those variables are heavily linked. Based on the recurring interventions by the Fed and Treasury, the tolerable level of real interest rates is likely in this ~2.5% area. So you have a situation where politicians want to keep a lid on nominal interest rates, which puts upward pressure on inflation expectations and the two together lead to falling real interest rates. Historically gold has been the go to hedge for this but I believe that is changing to Bitcoin.

Micro

In my recent Q4 outlook, I pointed out crypto’s “large liquidations, ETH futures ETF launch, government intervention beginning, SEC/regulatory mean reversion, changing political climate and stablecoin supply bottoming.” Adding to that list we also have:

The industry being cleaned up with fraudulent and bad actors jailed

The large bankruptcy overhangs being resolved positively

Positive SEC and regulatory developments unfolding as the BTC and ETH spot ETFs are set to arrive in early 2024

Continued growth in stablecoin supply

With about a dozen large asset managers now readying their Bitcoin and Ethereum spot ETF products for launch, I don’t think it should be underestimated what knock on effects this will have. Large sales and distribution teams educating capital allocators on digital assets, product and operational teams teaching regulators and policymakers on the ins and outs of blockchain technology and the leadership of these firms uncovering additional opportunities to expand their services within the ecosystem.

Up Next

Now we get to the fun part. On October 1st, I called for a big run in digital assets. But now I’m telling you to think bigger. What do I mean? In the 1970's, gold had a ~4x run over 2 years and an ~8x run over 4 years. Yes, gold. The sleepiest asset you ever will find. Bitcoin has many similar characteristics but can scale much quicker due to it is an innately global, instantly accessible and almost ‘viral’ asset.

The launch of Bitcoin, and soon after Ethereum, spot ETF products has been one of the most sought after achievements across crypto for years. This is a watershed moment that permanently legitimizes the asset class. Each day that goes by we get closer to the ETF approval and I expect the momentum to keep building.

True or false - do you believe total crypto trading volume will increase or decrease between now and the ETF launch in mid-January?

Next question - do you think that volume between now and then will be dominated by selling or buying?

As Bitcoin, Ethereum and crypto are plastered all over CNBC for the next two months, more and more people will begin to understand the opportunity at hand. Do you think they will wait for the ETF launch to buy in or try to front run it?

You are not bullish enough.

Why am I calling this the halfway mark?

We are just over halfway between the SEC’s 3-0 loss to Grayscale in late August and the expected Bitcoin ETF launch date in mid-January.

I don’t think $50,000 Bitcoin by ETF launch in January is out of the question.

What also is halfway? The GBTC discount. The current ~12% discount to NAV (88% of par) represents a ~13.6% return to NAV. 13.6% lower from here is a ~23% discount to NAV (~77% of par). This level was surpassed on Tuesday, August 29th when the SEC lost to Grayscale 3-0. Again, making today almost perfectly halfway in both discount to NAV and time.

You might be thinking this all sounds too perfect to be true. And yeah obviously I’m not basing my thesis around this, but it serves as a useful barometer for what is priced in. At the end of the day, it’s all about the flows. Review my thoughts on these GBTC flows from last month.

By definition, the ETF cannot be a sell the news event until GBTC is trading at NAV. GBTC is a proxy for flows into the space and the flows cannot be topped out if the discount still exists. Think about this. You might be thinking but what about inefficient markets or fees or levered funds that caused the severe liquidations and price dislocations? But none of that matters. It’s all in the price. And the level of the discount tells us the market is still not pricing in the ETF to the level they should. We just saw CME become the largest Bitcoin futures exchange by open interest. Institutions that trade on the CME don’t leave free money on the table. If the ETF were priced in, the GBTC discount would be closed plain and simple. Don’t overcomplicate it.

The higher the price of BTC goes into the ETF launch, the more it becomes a sell the news, but we are nowhere near that point today. Here is the GBTC discount to NAV plotted against BTC. This is why I don’t think $50,000 is that crazy.

Coinbase ($COIN)

I suggest you familiarize yourself with what this asset is capable of. Also, here’s COIN 0.00%↑ added to the chart from above. “The halfway point”.

But I think Coinbase is destined for even greater. As I think about assets I want to own going into what I believe will be one of the largest inflection points in the history of this nascent asset class, I wrote down a few characteristics I want to seek out:

Beaten down assets with the highest torque to a rebound in industry wide activity. In other words, if this isn’t just another ‘flash in the pan’ but is a prolonged and sustained increase in activity across the ecosystem, what do you want to own? For me that’s assets tied to broader industry trading volumes and on-chain activity. Coinbase is both of those.

Assets that are not well understood or ignored by key constituents (ie traditional equity investors) where industry experts have asymmetric information. Coinbase fits this. Find me a traditional tech or financial services hedge fund that understands staking (cbETH), stablecoins (USDC), layer 2 blockchains (Base) and long tail digital assets (spot and derivatives trading).

Assets that were liquidated by forced sellers. Many traditional investors who wanted to dip their toes into crypto bought Coinbase at or near its IPO. After all, why not have some exposure to one of the largest and most diverse businesses in the ecosystem? However as prices went south, it’s these sellers who capitulate the hardest and the most price insensitively. Judging by the COIN / BTC chart, this has not mean reverted to the upside enough given the broader crypto ecosystem’s repricing higher.

Crypto natives have already started buying assets in advance of the ETF. This can be seen in on-chain asset prices. And now it’s time for industry outsiders, bystanders and observers to get involved. Which assets do you think these newcomers will be looking to own? Mix in the broader favorable macro environment for equities and risk assets headed into January, COIN 0.00%↑ should also benefit from its higher market beta.

Where should the stock trade? I think 0.004 - 0.0045 BTC is about fair. This equates to $150-$200 based on different BTC price assumptions.

You are not bullish enough.

So if the above doesn’t have you questioning if you have enough exposure to the impending digital asset boom. I’ll leave you with a few big picture points to ponder for fun thought exercises.

What if you knew with 100% certainty, that the fundamental bottom for Bitcoin was ~$19,000 instead of the ~$15,000 bottom seen at the height of the FTX debacle. How would this change your outlook today? For starters, you could say that buying one Bitcoin today is risking $17,000 ($36,000 - $19,000) to gain $34,000 on a return to ATHs ($70,000 - $36,000). If you believe this to happen on a 12-24 month time horizon, that’s a pretty good bet. 2:1. How would this have changed your outlook when Bitcoin hit $25,000 in September? The same equation at that time would have meant risking a $6,000 loss for a $45,000 gain. Seems like even more meaningful information at that point. And now rewind even further backwards to post-FTX. This information would have been infinitely valuable! It’s useful to evaluate notions in their most extreme form. I put together this parabolic chart showing what can happen to Bitcoin’s price in these situations. Similar to the FTX ‘false bottom’, I look at March 2020’s COVID low as a similar phenomenon. With the Federal reserve set to restart its balance sheet growth next year, I don’t rule anything out.

Along the same tactics of questioning the status quo instead of focusing only on justifying the destination, use this the next time you get into a discussion with someone who advocates against Bitcoin and digital assets. While you will be hit with common objections like ‘it has no use cases’, ‘there’s no tangible value’, ‘the market is manipulated’, I suggest flipping these on their head in some way and rephrasing the objection back. ‘Okay so you don’t like Bitcoin’s monetary policy, but tell me why you like the Fed’s monetary policy that is set by a small group of academic economists in a closed door setting with decisions based off data that is lagged by multiple months and inaccurate information that is significantly revised many months later.’ It is always easier to poke holes and tear down than it is to build robust improvements. Nothing will ever be perfect but I believe we are truly in the early days of traditional monetary and fiscal policy being disrupted by real-time information facilitated on blockchains. Similarly, we are in the early days of money supply, access and custody being limited to a small number of Wall Street banks. It’s a bit ironic because over the past year, crypto has proven it doesn’t need the US to succeed. Innovation and entrepreneurs have moved offshore to pursue their aspirations, capital continues to flow into the ecosystem and adoption has grown. But with that said, crypto will be a better industry with the US in it and developed nations like the US have a lot to gain from implementing it. Like everything, as time passes the economic opportunity will become too great to be ignored and traditional Wall Street institutions will embrace the technology and asset class, leading to lobbying and education efforts to create a more inclusive regulatory environment. This is already underway and the structural shift in 12-24 months from now will be historic.