If you haven’t read my two most recent pieces linked above, you should as they will provide an understanding into how I’m seeing things.

This one is going to be brief but covers two very important and related current topics:

Are we due for a pullback? (no)

Have interest rates have cyclically peaked? (yes)

Are we due for a pullback? (no)

Everywhere I look, folks are calling for a pullback. It’s way too consensus for my liking. The go to phrase is “we’ve rallied back too much, too quick” with little else behind it.

In order to understand why the bears are too early, you have to understand what caused previous recent corrections. Let me explain.

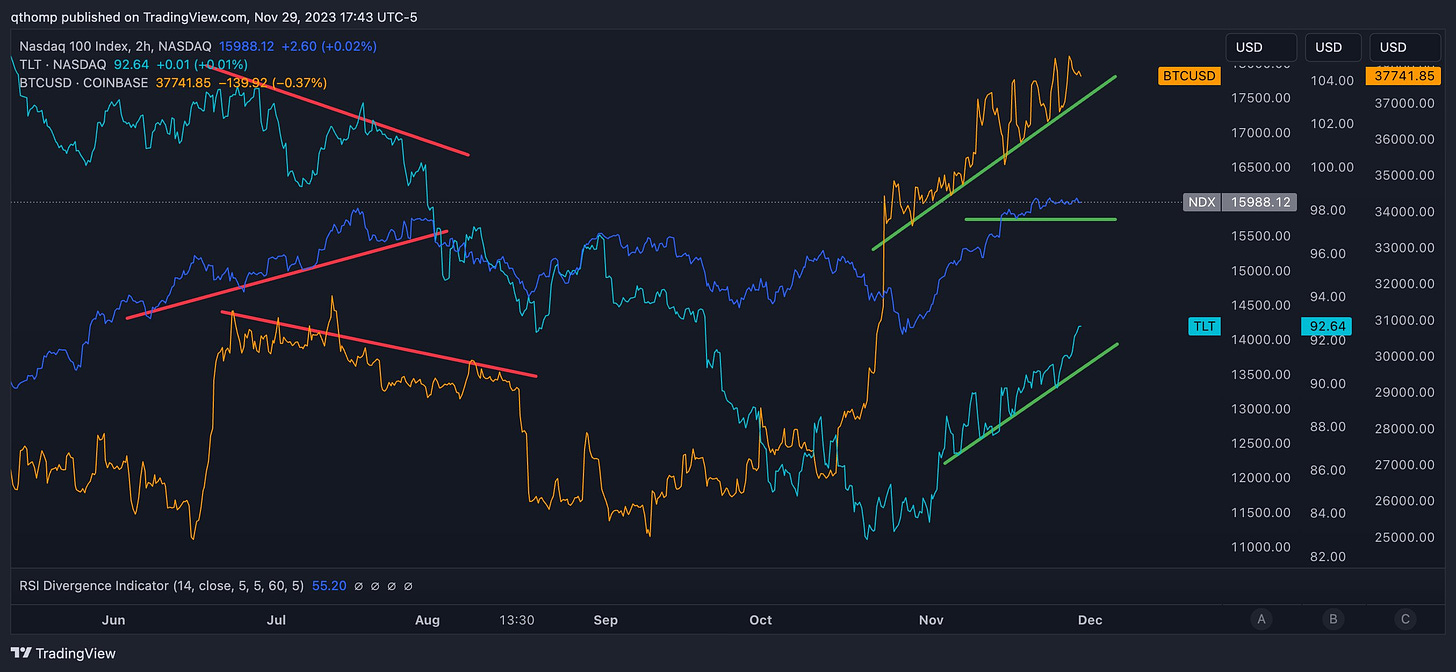

In early July I wrote a piece highlighting the risks of commodities, interest rates and inflation expectations rearing their head again. This was followed by an end of July rant predicting the ensuing bond market selloff. Both this recent August to October correction and 2022’s slow grind down bear market were preceded by a rise in long-term interest rates and largely due to a repricing of duration. In both cases the dollar also rose and then subsequently fell during the risk asset rallies.

But notice the difference in today’s interest rate and dollar price action. Treasury bonds are strongly bid while the dollar is weak. Risk assets are supported.

Why is this the case? Commodities are limp and dragging down inflation expectations with it.

This has allowed the Fed to pump the breaks on their hawkishness and reiterate the ‘extended pause’. If there ever is a ‘goldilocks’ looking situation, I believe we’re reaching the pinnacle. Inflation tamed while both the labor market and GDP growth remain strong. Now I do not necessarily endorse the expectation for a soft or no landing, but I am calling it how I see it and am not surprised risk assets are performing well.

The other major point I’d like to call out is the importance of Janet Yellen and the US Treasury’s recent actions to suppress long-dated bond yields via shortening the duration of issuance and tapping the remainder of the RRP. Each time a comparable action has been taken to bolster liquidity, markets have performed extremely well.

Have interest rates have cyclically peaked? (yes)

It’s very important to understand the tremendous shift going on in interest rates at the moment. Long-term rates look unbelievably peaked topped out.

Now I don’t necessarily think this means rates are going on a roundtrip express to zero. I’m generally in the higher for longer and structural inflation camp. But with that said, the market is sending a BIG signal.

Real yields also look very peaked.

And also very important on the topic of rates, 2s10s are very clearly in the midst of a broader steepening.

Nice charts, but what does this mean? What I have laid out above is the interest rate market telling you something big has changed. For now, it appears the inflationary impulse in the economy has been zapped. The momentum in interest rates is gone and the decline that typically precedes an economic slowdown has begun. The long and variable lags of monetary policy are starting to work through.

Putting it all together

Time and time again, the crowd is too early in calling for that slowdown to hit risk assets. For now, the market is still not done celebrating cyclically lower bond yields and at least a near-term relief from inflation.

By no means is it a buy and go to the beach for a year type of moment. It appears we are in the later stages of the cycle and more than ever it is critical to be paying attention, looking around corners and seeking out blind spots. But that does not mean we can’t have a face melting rally that further catches folks offsides. I’ll leave you with my parting message.

Press your longs.

I’ll get into what happens next at a later date, but for now that’s less relevant. I’ve given you the information you need. Follow me on Twitter if you want to stay up to date and learn more.